Most Americans don’t even have $500 in savings. Research shows 84% of us underestimate our monthly subscription costs and spend almost triple what we think we do.

We’ve put together a list of the best money-saving apps to help you take control of your finances in 2025. These apps can track your subscriptions and automate your savings. You’ll find tools to build an emergency fund (experts say you need 3-6 months of expenses) and cut unnecessary spending. Our tested apps will help you reach your financial goals.

We’ve reviewed 35 different money-saving apps and focused on the ones that work. Let’s discover how these tools can make your savings journey easier and more effective.

Rocket Money

Image Source: Rocket Money

Want to reduce your expenses? Rocket Money stands out as one of the most powerful money saving apps that has helped over 5 million members save more than $1 billion collectively.

Rocket Money Bill Analysis

Our experience with Rocket Money started as we connected our accounts. The app scanned our bills and subscriptions immediately. The platform automatically sorts expenses and spots recurring charges. Users have successfully canceled over $490 million in unused subscription fees through this app.

Rocket Money Negotiation

A simple and powerful negotiation system makes this app effective. The service partners with major cell phone, cable, and home security providers to reduce your bills. Their negotiators achieve an impressive 85% success rate. The process works like this:

- Upload your bill or connect your account

- Rocket Money’s negotiators reach out to providers

- Receive notifications about potential savings

- Payment applies only after successful bill reduction

Rocket Money Fees

The app’s pricing structure comes in two tiers:

- Free Version: Has simple account linking, balance alerts, and spending tracking

- Premium Version: Ranges between $4-$12 monthly, offering:

- Unlimited budgets

- Immediate balance updates

- Credit score monitoring

- Premium chat support

Rocket Money takes 30-60% of your first year’s savings for bill negotiations. To name just one example, a $20 monthly bill reduction saves you $240 yearly, resulting in a one-time fee between $72-$144.

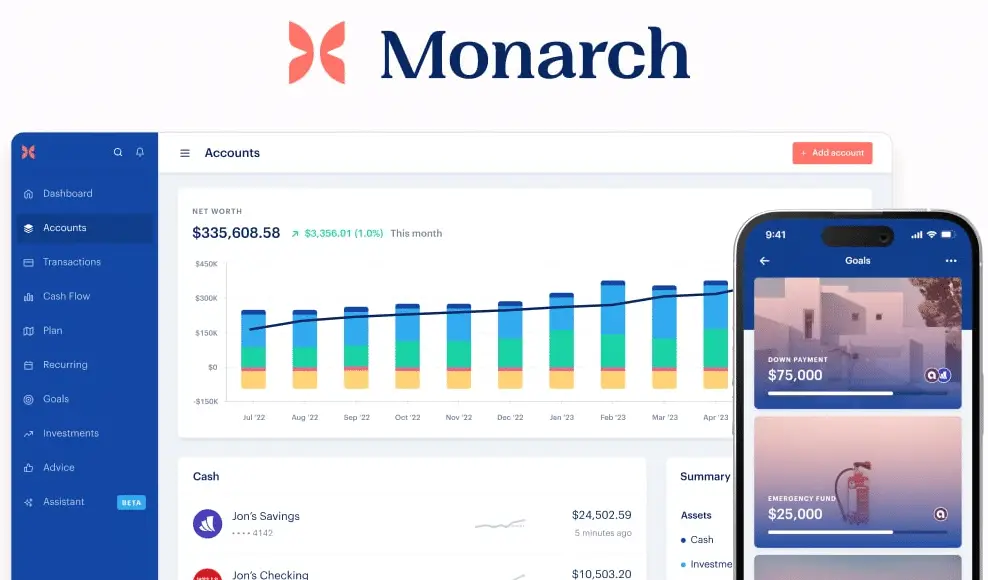

Monarch Money

Image Source: Monarch Money

Personal finance works best when it fits your style. Monarch Money stands out from other money saving apps because it lets you customize how you track your finances.

Monarch Money Budgeting

Monarch gives you two different ways to budget: Flex Budgeting and Category Budgeting. The app’s best features are:

- Custom notifications for spending alerts

- Two unique budgeting systems

- Subscription tracking

- Bill statement balance monitoring

- Unlimited account connections

Monarch Money Investments

The investment tracking features are really impressive. You get detailed portfolio monitoring that works with investment accounts of all types. You can link everything from retirement accounts to cryptocurrency investments and track your home and vehicle values through VIN number lookup.

Monarch Money Cost

We put the platform through its paces and the pricing is simple to understand. Monarch gives you a 7-day free trial, then two subscription options:

- Monthly: $14.99

- Annual: $99.99 (approximately $8.33 per month)

Monarch keeps the experience ad-free, unlike many free money saving apps. The platform makes shared features available at no extra cost, which is great when you have couples managing money together.

PocketGuard

Image Source: pocketguard.com

PocketGuard stands out with its intelligent automation among the best money saving apps we’ve tested. The platform has already helped 825,754 people improve their money management skills.

PocketGuard Spending Analysis

The automated expense tracking in PocketGuard is powerful and connects to more than 18,000 financial institutions. The app’s standout feature, “In My Pocket,” calculates your available spending money after accounting for bills and necessities. Users get notifications when spending hits 50% of their budget in any category.

PocketGuard Bill Tracking

The bill tracking capabilities showed impressive results during testing. The platform’s AI algorithm identifies recurring merchants and automatically schedules them in your calendar. The app excels at subscription management by:

- Detecting unwanted subscriptions

- Providing cancelation instructions

- Monitoring recurring payment changes

- Alerting about upcoming bills

PocketGuard Premium

The free version offers simple features, but PocketGuard Plus provides improved capabilities at $12.99 monthly or $74.99 annually. Premium members get access to:

- Unlimited bank connections

- Custom categories

- Transaction exports

- Debt payoff planning

- Receipt attachments

- Multiple cash accounts

PocketGuard’s steadfast dedication to privacy sets it apart. The platform uses bank-level 256-bit SSL encryption and doesn’t sell user data to advertisers. Your financial information stays secure while you work toward your savings goals.

Goodbudget

Image Source: Goodbudget

We tested Goodbudget’s fresh take on digital envelope budgeting that brings the traditional cash envelope system into today’s world. This money saving app helps you plan your spending before it happens instead of just tracking past expenses.

Goodbudget Envelope System

The app’s best feature lets you create digital envelopes for different spending categories. You can sync and share your budget across multiple devices. This makes it perfect for couples who want to manage their finances together. The platform lets you set aside specific amounts for regular expenses like groceries and entertainment, plus annual costs such as holiday shopping.

Goodbudget Debt Tracking

The debt tracking feature stands out with its complete approach. The app supports:

- Multiple debt account tracking

- Payoff progress monitoring

- Payment scheduling

- Expected payoff date calculations

Goodbudget Subscription

The app has three distinct pricing tiers:

- Free Plan has:

- Up to 20 envelopes

- One account

- Access on two devices

- One year of history

- Plus Plan: $8/month or $70/year

- Premium Plan: $10/month or $80/year with bank sync features

The Premium plan proves especially valuable with its unlimited envelopes, accounts, and automatic bank synchronization. The platform helps users create intentional spending habits rather than just tracking expenses after the fact.

EveryDollar

Image Source: Ramsey Solutions

We’ve tested many money saving apps, and EveryDollar’s zero-based budgeting approach works really well. Ramsey Solutions created this app in 2015, and it now has a community of over 10 million budgeters.

EveryDollar Budget Tools

The app’s best feature is its zero-based budgeting system that gives each dollar a specific job. Users typically find an extra $790 in their first two months with the app. We can create unlimited budget categories to customize our spending plan exactly how we want.

EveryDollar Tracking

The tracking features are reliable despite the simple interface. The free version needs manual transaction entry, but this hands-on method helps us stay aware of our spending. The app shows each category’s percentage of total spending, which makes spotting areas to improve much easier.

EveryDollar Premium

The premium version costs $17.99 monthly or $79.99 annually and has these features:

- Bank account connectivity with transaction streaming

- Paycheck planning based on due dates

- Custom budget reports and data exports

- Live Q&A sessions with financial coaches

- Net worth tracking and goal setting

Like other premium services, EveryDollar gives you a 14-day free trial. Our tests show the premium features are worth the cost, as users typically reduce monthly expenses by nearly 10%.

Stash

Image Source: Stash

Looking for money saving apps that blend investing with banking? Our extensive testing of Stash shows it is a chance to get both services in one place. This app stands out because it lets users invest in fractional shares of over 3,800 stocks and ETFs.

Stash Investment Options

Stash provides both DIY investing and automated portfolio management. Users can start investing with just $5. The platform gives you access to:

- More than 90 ETFs from leading providers

- Customizable portfolios based on risk tolerance

- Smart Portfolio option for hands-off investing

Stash Banking Features

The platform’s banking services shine with their practical rewards system. Users can earn stock rewards on everyday purchases with the Stock-Back® Card. The platform includes:

- No overdraft or hidden fees

- Access to 55,000+ fee-free ATMs

- Early direct deposit up to 2 days ahead

- Automatic savings tools with round-ups

Stash Monthly Plans

The platform has two subscription options that fit different needs:

Growth Plan ($3/month):

- Personal investment portfolio

- Smart Portfolio management

- Retirement account access

- Basic Stock-Back® rewards

Plus Plan ($9/month):

- Everything in Growth

- Enhanced Stock-Back® rewards

- Two custodial accounts

- $10,000 life insurance coverage

Robinhood

Image Source: Robinhood Newsroom

Our testing shows Robinhood stands out as an excellent choice that combines investing with cash management. The platform has changed the way we think about saving through investing.

Robinhood Trading

The platform’s commission-free trading for stocks, ETFs, options, and cryptocurrencies makes it attractive. The new Robinhood Legend desktop platform gives active traders advanced charting features. Users can trade select stocks 24 hours between 8:00 p.m. Sunday and 8:00 p.m. Friday.

Robinhood Cash Management

The platform’s competitive rates and cash management features are impressive. Users get a debit card and can access 75,000 fee-free ATMs. Gold members earn 4.65% APY on their uninvested cash, and partner banks provide FDIC insurance coverage up to $2.50 million.

Robinhood Gold

Gold membership costs $5 monthly and includes these premium features:

- 4% APY on uninvested cash

- Professional research from Morningstar

- Level II market data from Nasdaq

- Interest-free borrowing on first $1,000 margin

- Instant deposits up to $50,000

- 3% IRA contribution match

The Gold Card rewards users with 3% cash back on all purchases and 5% on travel bookings. These features are a great way to get value for both active traders and long-term investors who want to maximize their savings.

Webull

Image Source: Webull

Our analysis of many money saving apps shows Webull’s advanced technical analysis tools make it different from simple investing platforms. The platform combines sophisticated features that remain accessible to new and experienced investors.

Webull Investment Tools

Webull’s complete charting capabilities impressed us with over 50 technical indicators and 60 technical signals. The platform gives you:

- Immediate market data with Level 2 quotes

- Full order book depth analysis

- Customizable chart layouts

- Paper trading simulator with unlimited virtual cash

Webull Trading Features

The platform excels with commission-free trading for stocks, ETFs, and options. The paper trading feature lets users test strategies risk-free with immediate market data. Users can trade during extended hours from 4 AM to 8 PM ET.

Webull Account Types

Webull provides multiple account options that match different needs. Users can open basic accounts without minimum deposits. Margin accounts need:

- Minimum $2,000 equity balance

- Maintenance of 25% total account value as equity

- Access to up to 4x day-trade buying power

The platform’s support for Traditional, Roth, and Rollover IRAs makes it a versatile choice among money saving apps for long-term investors.

Chime

Image Source: Chime

Chime’s fee-free approach stands out in our quest to find the best money saving apps. This fintech platform works with FDIC-insured banks to provide complete banking services without traditional costs.

Chime Banking Features

Chime eliminates common banking fees and offers competitive rates. Their savings account earns up to 2% APY and serves as a powerful tool to build emergency funds. The platform provides:

- Early direct deposit up to 2 days ahead

- Access to 50,000+ fee-free ATMs

- Automatic savings features with Round Ups

Chime SpotMe

The SpotMe feature has changed how we handle unexpected expenses. This overdraft protection program covers up to $200 in transactions without fees. Eligible members must:

- Receive monthly direct deposits of $200+

- Activate their Chime debit or credit card

- Maintain good account standing

Chime Credit Builder

We tested the Credit Builder secured credit card, which helps members improve their credit scores. Users see an average increase of 30 points in their FICO scores. The card comes with:

- No annual fee or interest charges

- No credit check required

- Automatic payment options

- Reports to all major credit bureaus

Current

Image Source: Current

Current stands out as one of our favorite money saving apps for both individual and teen banking needs. We focused on family financial management and found its mix of banking and budgeting tools works great for modern families.

Current Banking Tools

The app’s core features are practical and user-friendly. Users can get their direct deposits up to two days earlier, which helps with cash flow management. The app has fee-free overdraft protection up to $200 for users who qualify with direct deposits of $500 or more.

Current Teen Banking

The teen banking features are reliable and comprehensive. Parents can:

- Set spending limits and block specific merchants

- Receive instant purchase notifications

- Transfer money immediately to teen accounts

- Monitor ATM withdrawals

- Enable direct deposit for teen paychecks

Current Premium

The platform’s premium features are a great way to get substantial value. The service has three savings pods that can earn up to 4% APY. Some fees apply, including:

- Out-of-network ATM fee: $2.50

- Foreign transaction fee: 3% (minimum $0.50)

- Card replacement: $5.00 standard, $30.00 standard shipping

- Cash deposit fee: $3.50 per deposit

Current’s steadfast dedication to financial education makes it different from other money saving apps. Our research showed that 75% of Americans now use one or more banking apps. The app’s blend of teen banking and savings tools makes it an excellent choice for families who want to improve their financial habits.

Albert

Image Source: Albert

Our extensive testing of many money-saving apps brought us to Albert. This platform stands out by combining AI-powered savings with human financial guidance.

Albert Savings Features

Albert’s Smart Savings tool caught our attention with its ability to set aside $25 to $100 automatically each week. The system looks at your income patterns and spending habits to figure out the best saving amounts. Genius members can earn a 0.25% annual bonus on their savings accounts, while simple accounts earn 0.10%.

Albert Investing

Albert makes investing simple with just a $1 minimum to start. Users get these benefits:

- Commission-free trading of stocks and ETFs

- Customized portfolios based on risk tolerance

- Themed investment options that focus on sustainability and emerging markets

Albert Genius

The Genius subscription has proven to be worth every penny for detailed financial management. Members pay $11.99 monthly and receive:

- Direct text access to real financial advisors

- Customized investment portfolios

- Fee-free ATM withdrawals at AllPoint locations

- Cash-back rewards on purchases

Albert distinguishes itself by blending automated tools with human expertise. We can text and ask about everything from simple budgeting to complex investment strategies. The platform works well for both hands-off savers and active investors, making it a versatile option among money-saving apps.

Empower

Image Source: Empower

Empower stands out from other money saving apps by combining high-yield savings with customized investment guidance. The platform manages over $1.4 trillion in assets and serves more than 18 million users.

Empower Banking

Empower’s impressive 3.75% APY on cash management accounts caught our attention quickly. This rate outperforms traditional savings accounts by a lot over time. The platform has:

- Multi-factor authentication security

- FDIC insurance coverage

- Direct deposit capabilities

- No account minimums or fees

Empower Investing

Empower’s investment guidance matches premium wealth management services. The management fee is 0.89% to manage portfolios under $1 million. The service has:

- Custom portfolio creation

- Daily rebalancing checks

- Retirement planning tools

- Access to financial advisors

Accounts between $100,000 and $250,000 focus on ETF investments. Accounts over $250,000 can access individual stocks.

Empower Cash Advance

The cash advance feature proved useful especially when you have unexpected expenses. Users can get:

- Up to $300 instant advance

- No interest charges

- No late fees

- No credit checks required

Users need to pay a monthly subscription of $8, but new users get a 14-day free trial. Our analysis shows Empower’s mix of high-yield savings, professional investment management, and flexible cash advances makes it a versatile choice to manage money effectively.

SoFi

Image Source: SoFi

SoFi’s evolution from a student loan refinancer to a complete financial platform has impressed us, especially when you have to manage money. The platform helps millions of users manage their finances better.

SoFi Money Management

SoFi’s approach to budgeting and expense tracking works well. Users can connect their accounts to more than 12,000 financial institutions. Our testing found that there was a set of outstanding features:

- Automatic spending categorization

- Weekly credit score updates

- Bill payment tracking

- Custom budget creation

SoFi Invest

SoFi’s investment platform stands out because of its versatility. Users get commission-free trading with both automated and self-directed options. The platform charges just 0.25% annually to manage automated investments. The platform excels with:

- Commission-free stock and ETF trading

- Automated portfolio management

- Professional research tools

- Retirement account options

SoFi Membership

SoFi Plus membership provides better benefits than traditional banking services for users with direct deposit. Members get:

- Up to 4.00% APY on savings

- 1% unlimited match on recurring deposits

- 10% boost on credit card rewards

- Access to financial advisors

- Career coaching services

Betterment

Image Source: Betterment

Our research shows Betterment’s automated investment approach has set new standards for building wealth. The platform combines sophisticated investing with practical banking solutions, and our tests have proven its effectiveness.

Betterment Investing

Betterment’s portfolio strategies are impressive with both Core and Socially Responsible Investment options. The platform stands out with its 101 individualized risk levels that adapt to specific financial goals. You can start investing with just $10. This makes it available to beginners while providing advanced features that experienced investors need.

Betterment Banking

Betterment’s banking features work seamlessly with its investment services. The checking account includes:

- No minimum balance requirements

- ATM fee reimbursements worldwide

- Cash back rewards at thousands of brands

The Cash Reserve account features a competitive 4.00% APY. Your money stays protected with FDIC insurance up to $2 million through program banks.

Betterment Fees

The platform has clear pricing tiers:

- Digital Plan: $4 monthly or 0.25% annually

- Premium Plan: 0.65% annually (requires $100,000 minimum)

Balances above $2 million get a 0.10% fee discount. The Premium plan gives unlimited access to certified financial planners, making it a great choice to manage your money comprehensively.

Wealthfront

Image Source: Wealthfront

Wealthfront stands out from other money saving apps because of its sophisticated automation powered by PhDs. The software-first approach works especially well for hands-off investors who want professional-grade portfolio management.

Wealthfront Automation

Our daily monitoring shows how the platform automatically rebalances portfolios and harvests tax losses. The system gives you access to over 200 ETFs and cryptocurrency funds to boost customization. The platform’s automated features include:

- Tax-sensitive rebalancing

- Intelligent dividend reinvestment

- Smart beta optimization for larger accounts

- Daily tax-loss harvesting opportunities

Wealthfront Planning

The Path financial planning tool knows how to answer more than 10,000 financial questions, which impressed us. We can map multiple scenarios with this tool, from retirement planning to home purchases, without calling advisors. Path is completely free and available before you start investing, which makes it even more impressive.

Wealthfront Pricing

The platform keeps a straightforward fee structure at 0.25% annually for automated investing accounts. A $100,000 portfolio costs approximately $20.55 monthly. You need just $500 to start investing with Wealthfront, making it available for most savers. The platform’s tax-loss harvesting saves 6.5 times the advisory fee annually, which shows exceptional value compared to other automated investment services.

M1 Finance

Image Source: M1 Finance

We tested several money-saving apps and M1 Finance stands out with its fresh take on customizable investing. The platform’s “Pie” investment model helps users build portfolios from over 6,000 stocks and ETFs.

M1 Investing Platform

M1 shines with its commission-free trading and zero management fees. The platform’s dynamic rebalancing system automatically puts new deposits to work and maintains target percentages. Retirement planners need a $500 minimum to open IRAs.

M1 Banking Services

The platform’s banking features work seamlessly with its investment tools. Plus members earn a competitive 4.00% APY in their high-yield savings accounts. The banking experience includes these essential features:

- FDIC insurance through partner banks

- Direct deposit capabilities

- Automated cash management

- Investment integration

M1 Plus Benefits

The M1 Plus subscription costs $125 annually and comes with premium perks:

- Extra afternoon trading window

- Lower borrowing rates

- Smart transfers for automated money movement

- Owner’s Rewards Card with up to 10% cash back at select merchants

The platform uses bank-level encryption to keep accounts secure while providing smooth access to investing, banking, and borrowing services.

Public

Image Source: Public app

Our evaluation of money-saving apps shows Public stands out with its unique mix of AI-powered investing and social learning features. The platform has led the way in commission-free fractional investing and community-based wealth building since 2019.

Public Investment Options

Public brings together several investment opportunities on a single platform. The Bond Account offers an impressive 7% locked-in yield, which beats traditional savings accounts. Users can also earn 4.1% APY with FDIC insurance up to $5 million through the platform’s High-Yield Cash Account.

Public Social Features

Public’s AI-powered investment research assistant is a standout feature. Users can ask questions about any stock and get quick breakdowns of earnings calls. The platform’s community feed lets users:

- Share investment insights with other users

- Create focused chat groups

- Participate in live investing events

- Connect with company executives through town halls

Public Account Types

Account value determines the tier of benefits:

- Premium ($50,000+):

- Free extended-hours trading

- Free Investment Plans

- Priority support

- Concierge ($250,000+):

- White-glove VIP support

- Tailored offers

- Exclusive event invites

The Investment Plans feature adds great value by letting users schedule recurring investments across up to 20 different assets.

Fidelity Spire

Image Source: Fidelity Investments

Our search to find effective money saving apps led us to Fidelity Spire. The app’s goal-focused approach revolutionizes financial tracking. Its free version impresses users with a simple design and smart decision-making tools.

Fidelity Goals Planning

The platform excels at defining and tracking multiple financial goals. Users can select financial categories that include emergency funds, retirement, and debt goals. The system then calculates required savings and estimates completion dates based on short-term or long-term objectives.

Fidelity Investment Tools

The app offers two powerful investment options for long-term goals:

- Self-directed investing for hands-on control

- Fidelity Go robo-advisor with $0 fees for balances under $10,000

Fidelity Go’s fee structure remains competitive at $3 monthly for accounts between $10,000 and $49,999.

Fidelity Account Features

The Cash Management Account stands out with these practical benefits:

- No minimum balance requirements

- Zero account fees

- ATM fee reimbursements

- Free bill pay services

The platform’s education hub delivers essential content about budgeting, career planning, and investing basics. The decision tool helps users review trade-offs between financial goals and prioritize savings efficiently.

Marcus

Image Source: Marcus by Goldman Sachs

Marcus by Goldman Sachs stands out among the best money saving apps we’ve tested. The platform delivers premium savings rates without extra fees and its simple banking approach helps maximize returns.

Marcus Savings Tools

The high-yield savings account caught our attention with its competitive 3.90% APY and zero minimum deposit requirements. The mobile app comes packed with useful features:

- Recurring deposit scheduling

- Transaction tracking

- Annual interest earnings monitoring

- Easy fund transfers

Marcus Investing

Marcus has enhanced its investment offerings through a mutually beneficial alliance with Betterment. This partnership gives users access to sophisticated portfolio management while they enjoy high-yield savings benefits.

Marcus Account Types

The platform provides several savings options that align with different financial goals. High-yield CD accounts offer 4.25% APY for 12-month terms with a reasonable $500 minimum deposit. Users can withdraw earned interest anytime without penalties, which adds flexibility.

Marcus shows its steadfast dedication to transparency with zero monthly maintenance fees or hidden charges. The platform doesn’t include checking accounts or ATM access, which makes it better suited for dedicated savings goals than everyday banking needs.

Ally

Image Source: Ally

Our complete evaluation of money saving apps shows that Ally’s smart savings tools work really well. Users save twice as much on average with the platform’s savings buckets feature.

Ally Banking Features

Ally’s high-yield savings account stands out with a competitive 3.80% APY, beating the national average of 0.42% by more than 5 times. The platform impresses with these features:

- Zero monthly maintenance fees

- No minimum opening deposits

- Automatic savings tools with round-ups

- Surprise savings transfers

Ally Invest Tools

Ally’s investment platform excels in accessibility and comes packed with complete features. You can trade stocks, ETFs, and options without commission. The service lets you start investing without an account minimum, and transferring investments or full accounts from other firms earns you a $75 credit.

Ally Account Options

You’ll find a variety of account types that match different financial goals. Ally’s cash management system reimburses up to $10 per statement cycle for ATM fees nationwide. Key features include:

- High-yield savings with bucket organization

- Interest-bearing checking accounts

- Commission-free investment accounts

- Retirement account options

The platform provides great value with its SIPC protection up to $500,000, which includes $250,000 for cash claims.

Varo

Image Source: Varo

We tested Varo’s money-saving approach and found that there was something special about this digital bank. Varo stands out as one of the first all-digital banks with a national charter, and it changes what we expect from banking apps.

Varo Banking Features

Varo’s fee-free banking system impressed us right away. You don’t need a minimum balance, and there are no monthly maintenance fees. The bank gives access to more than 55,000 fee-free Allpoint ATMs across the country. Your paychecks can hit your account up to two days early with their direct deposit feature.

Varo Savings Rules

The bank’s tiered savings structure caught our eye. You can earn an impressive 5.00% APY on balances up to $5,000 by meeting two simple rules:

- Monthly direct deposits of $1,000 or more

- Both checking and savings accounts must stay positive

Balances above $5,000 still earn a solid 2.50% APY baseline rate.

Varo Account Benefits

The automatic savings tools helped us build our emergency fund better. The bank offers two key features:

- Save Your Pay: Your direct deposits automatically send a percentage to savings

- Round-ups: Every purchase rounds up to the nearest dollar and moves the difference to savings

Varo’s cash advance program helps with surprise expenses by offering up to $100 with fees between $0 and $5. The Varo Believe secured credit card adds value by reporting to major credit bureaus.

Dave

Image Source: Dave

We’ve been learning about innovative money saving apps and found Dave’s unique approach to preventing overdraft fees while promoting savings. The platform has proven its value with over 6 million members taking 97 million advances to help users manage unexpected expenses.

Dave Banking Tools

Dave’s checking account eliminates common banking hurdles. The platform gives users a competitive 4.00% APY on savings and works well for building emergency funds. The Goals feature lets users create both private and public savings targets that help them stay accountable while working toward financial objectives.

Dave ExtraCash

Dave’s ExtraCash advance feature makes it stand out by offering up to $500 with no interest or late fees. The qualification process is straightforward and needs:

- Monthly deposits totaling $1,000 or more

- At least three recurring bank deposits

- A positive bank balance

- 60-day minimum account history

Dave Membership

Dave charges a simple $1 monthly fee that gives you access to:

- Early direct deposit up to 2 days ahead

- Side hustle board with remote work opportunities

- Instant surveys for quick cash

- Access to 37,000 surcharge-free ATMs

Express fees range from $1.99 to $13.99 for instant transfers, while standard transfers stay free. Dave ended up combining practical banking tools with innovative cash advance features that make it a standout choice among money-saving apps.

Brigit

Image Source: Brigit

Our team tested many money saving apps, and Brigit’s detailed approach to financial wellness stands out, especially when you have to manage your money wisely. The platform helps over 4 million members save money through smart budgeting and quick cash access. These members have saved more than $750 million in fees.

Brigit Cash Advance

Brigit’s instant cash advance system impressed us with its simple approach. Users can get advances between $50 to $250, and approval depends on a score from 0 to 100. The qualification requirements include:

- An active account for 60+ days

- Three recurring deposits

- A positive balance

Brigit Budgeting

The Finance Helper tool has changed how we monitor our spending patterns. We learned about our earnings and spending trends through the system’s analytics. The Bill Forecast feature sends alerts about upcoming expenses and helps users avoid overdrafts.

Brigit Plus Features

Plus membership costs $9.99 monthly and includes valuable features like:

- Credit building tools

- Immediate balance alerts

- Bill payment tracking

- $1M identity theft protection

The platform’s credit builder service sends reports to major credit bureaus. Users who started with credit scores below 600 showed significant improvements. After extensive testing, we found that Brigit’s combination of automated savings tools and instant cash access makes it an excellent choice among money-saving apps.

MoneyLion

Image Source: MoneyLion

We learned about money saving apps and found MoneyLion’s focus on credit building and financial strength stands out. The platform has helped over 5 million members boost their financial health.

MoneyLion Banking

We value MoneyLion’s RoarMoney account because of its practical features. Users can get cash advances up to $1,000 by connecting a RoarMoney account. Funding takes two to five business days, and users can opt for express delivery by paying a small fee.

MoneyLion Investing

MoneyLion’s investment features impressed us with these capabilities:

- Automated portfolio management

- Cryptocurrency trading options

- Traditional investing without advance fees

- Customizable investment strategies

MoneyLion Credit

Credit Builder Plus membership has revolutionized credit improvement methods. Members see a 25-point increase in their credit scores within 60 days. The service includes:

- Credit builder loans up to $1,000 with no hard credit check

- Weekly credit score updates

- Automated alerts for credit changes

- Reports to all three major credit bureaus

MoneyLion stands out because of its detailed approach to financial wellness. Users can choose between two membership levels: MoneyLion Core for simple features and MoneyLion Plus for additional benefits. Our tests show that credit-building tools work well, and members can earn up to $19.99 cashback monthly to offset membership costs.

Credit Karma

Image Source: Credit Karma

Our thorough testing of money saving apps shows Credit Karma stands out by knowing how to combine credit monitoring with practical banking solutions. The platform keeps track of our credit reports from both Equifax and TransUnion and sends instant alerts when important changes occur.

Credit Karma Monitoring

Credit Karma helps us detect potential identity theft and errors on our credit reports. The platform provides:

- Free VantageScore 3.0 credit scores

- Regular credit report updates

- Identity monitoring for data breaches

- Direct dispute assistance for credit report errors

Credit Karma Savings

The platform’s high-yield savings account grabbed our attention with its competitive 4.1% APY. We found these account features impressive:

- FDIC insurance up to $5 million through partner banks

- No minimum balance requirements

- Zero monthly maintenance fees

- Automatic savings tools

Credit Karma Money

The banking features make our financial management easier. Credit Karma Money lets users access direct deposits up to two days early. Members who deposit $750 or more monthly can get $20 in overdraft coverage without fees or interest. Users can access over 55,000 fee-free ATMs nationwide with their debit card.

NerdWallet

Image Source: NerdWallet

Our analysis of money saving apps shows that NerdWallet rewards smart financial decisions in a unique way. The platform gives up to $425 each year in cash rewards and savings with its premium membership.

NerdWallet Insights

The platform stands out because of its detailed financial planning approach. NerdWallet Planning helps create tailored strategies that eliminate debt and grow investments. The Smart Money Podcast answers real-life financial questions from experts. This helps users make better decisions about their money.

NerdWallet Tools

The app’s tracking features are versatile and powerful. Users can track:

- Net worth calculations across all accounts

- Spending patterns with 50/30/20 budget guidelines

- Credit score changes with instant alerts

- Tailored financial insights

NerdWallet Premium

NerdWallet Plus membership costs $49 yearly and changes the way users handle their finances. Premium users get:

- Exclusive access to Treasury accounts

- Insurance optimization tools

- Direct access to financial experts

- Tailored product recommendations

The platform’s steadfast dedication to security uses bank-level encryption to protect all data. Users benefit from credit monitoring service that updates VantageScore and spots potential errors in their reports.

Clarity Money

Image Source: PCMag

Clarity Money stands out among money saving apps because it knows how to identify and eliminate wasteful spending. The platform’s AI-powered analysis has helped millions of users take control of their finances.

Clarity Money Analysis

The app’s expense tracking capabilities are detailed yet user-friendly. Users can connect to over 9,000 U.S.-based financial institutions to get a comprehensive view of their spending patterns. The system automatically categorizes credit card transactions, which makes budget tracking effortless.

Clarity Money Savings

This platform’s prompted savings feature through Marcus by Goldman Sachs makes it unique. Users can open a high-yield savings account directly through the app and get automated saving assistance to reach their financial goals. The platform’s subscription management tool is especially valuable when you have recurring expenses that often go unnoticed.

Clarity Money Features

The app shines with its practical money-management tools:

- Multi-level security safeguards with encrypted data transmission

- Monthly credit score checks at no cost through VantageScore 3.0

- Push notifications for payments, low balances, and spending alerts

- Detailed merchant spending analysis over customizable time periods

Our tests showed that the platform excels at providing spending insights. It gives detailed breakdowns that show how trips to specific merchants add up over time. The user-friendly interface makes it simple to track financial progress without feeling overwhelmed.

Prism

Image Source: BillGO

We tested Prism’s optimized approach to organizing monthly expenses by examining money-saving apps that make bill management easier. The platform connects with over 11,000 billers and lets users track all payments in one convenient location.

Prism Bill Management

The platform works as a central hub that eliminates the need for multiple payment portals. Users can access their billing information automatically from service providers through a system that offers:

- Immediate balance updates

- Due date tracking

- Payment history monitoring

- Customizable bill alerts

Prism Payment Tools

The payment process stands out with its flexibility. Users can schedule payments ahead of time or automate recurring bills after connecting their accounts. A detailed calendar view shows upcoming due dates and payment amounts clearly.

Prism Premium

Prism’s dedication to free services caught our eye. The platform earns through small fees from billers who get faster payments instead of charging users. A $15.00 returned item fee applies when payments get declined. The platform’s Payment Promise guarantees reimbursement up to $1,000 for late fees if payments miss their scheduled arrival date.

Billshark

Image Source: Billshark

Our team has found Billshark stands out among money-saving apps with its remarkable results in reducing monthly expenses. The platform achieves an impressive 90% success rate when it comes to lowering bills, and this changes the entire approach to bill negotiations.

Billshark Negotiation

The negotiation process works smoothly and gets results. The platform helps reduce costs for:

- Internet and wireless services

- Pay TV and satellite radio

- Home security systems

- Cable subscriptions

Billshark Savings

The numbers tell the story clearly. Users save between $300-$500 per bill on average, and one customer saved an incredible $9,500 in total. The platform aims to cut bills by at least 25%, which leads to significant long-term savings.

Billshark Fees

Billshark keeps its fee structure simple. They take 40% of your total savings over a 2-year period. A $15 monthly saving over 12 months ($180 total) would cost $72 in fees. Users can pay through various methods, including PayPal Pay Later when they qualify. Canceling subscriptions costs a flat $9 fee per service.

Billshark’s free insurance rate check tool adds extra value, helping users save over $450 on home and auto insurance. Your financial data stays safe during negotiations thanks to bank-level security with 256-bit encryption.

Hiatus

Image Source: FinanceBuzz

We tested many money saving apps for subscription management and Hiatus clearly leads the pack with its smart bill tracking features. Users have saved significant money through the platform’s subscription management and bill negotiation capabilities.

Hiatus Subscription Tracking

The platform shines at detecting and organizing recurring expenses. Hiatus quickly finds all subscription services, which helps users spot forgotten free trials and unwanted charges. The cancelation process works smoothly – users select the subscription, tap “Manage subscription,” and follow simple steps.

Hiatus Bill Analysis

This platform stands out because of its detailed bill analysis system. It compares user rates with others and spots bills that could get better terms. Their concierge team handles all negotiations to secure the best rates for monthly expenses.

Hiatus Premium

The Premium membership has changed our financial management by providing:

- Detailed financial analysis with individual-specific tips

- Smart budget creation tools

- Subscription cancelation services

- Bill negotiation assistance

Hiatus comes with flexible pricing options. The annual plan costs $48.00 ($4.00 monthly), which is the most affordable option. Monthly subscribers pay $9.99 per month. The premium service includes a satisfaction guarantee with full refunds for eligible customers.

Cushion

Image Source: LinkedIn

Money saving apps have seen remarkable changes, and Cushion stands out among them. The platform ended up becoming a complete bill tracker after starting as a fee-fighting service in 2016. This transformation changed how people manage their Buy Now, Pay Later (BNPL) obligations.

Cushion Fee Fighting

Cushion led the way in automated bank fee negotiations during its original phase. The platform used AI technology to review transaction histories and find potential fee reductions. This approach arranged incentives between the company and its users – Cushion earned money only when its customers saved money.

Cushion Analysis

Our tests showed that Cushion’s bill tracking features work remarkably well. The platform gives you:

- Calendar-based payment dashboard

- Total monthly BNPL payment tracking

- Remaining payment calculations

- Due date monitoring

Cushion Subscription

Cushion offers a tiered pricing structure that meets different user needs. The simple bill organization service costs nothing. Credit building features come with two options:

- BNPL Builder: $4.99 monthly for credit building with BNPL payments

- Cushion PRO: $12.99 monthly for complete credit building across all bills

The platform’s virtual card system sends payment activity to credit bureaus every month. This helps users build their credit history through regular bill payments. We found the platform’s method to combine multiple BNPL obligations into a single dashboard particularly impressive. This makes tracking payment schedules easier and helps avoid missed payments.

Copilot

Image Source: copilot.money

We looked at many money saving apps and Copilot stood out with its mix of AI automation and easy-to-use design. Every feature shows how much they care about users’ experience, from budgeting with emojis to smart sorting of transactions.

Copilot Money Tracking

We were impressed by how Copilot combines transactions from all linked accounts into one clear dashboard. The app handles recurring transactions well and automatically spots upcoming bills to predict future expenses. The smart sorting system makes custom rules that learn from our spending habits.

Copilot Insights

Our tests showed that Copilot’s “Month in Review” gives detailed summaries of spending, budgets and cash flow. The app comes with useful visual tools:

- Interactive budget circles to track spending

- Visual breakdowns of asset allocation

- Custom spending categories with emojis

- Detailed forecasts for recurring payments

Copilot Premium

The premium service costs $13.00 monthly or $95.00 yearly. Subscribers get access to:

- AI-powered expense sorting

- Complete investment portfolio tracking

- Unlimited account connections

- Advanced budget rebalancing tools

- No targeted advertising

Copilot stands out because it protects privacy by making money from subscriptions instead of selling user data. Our long-term testing showed that better budgeting usually saves enough to cover the subscription cost.

Emma

Image Source: emma-app.com

We tested several money saving apps and Emma’s individual-specific approach to financial tracking stands out. The app has earned a stellar 4.6-star rating and revolutionizes the way we handle our finances.

Emma Budget Analysis

Emma’s analytics section gave an explanation about our spending patterns that impressed us. The app automatically sorts transactions from all accounts and shows detailed breakdowns by merchants and categories. The system leaves out transfers to savings accounts and credit card repayments from analytics, which ensures accurate spending analysis.

Emma Subscription Tracking

Emma shines at spotting recurring payments. The platform creates a list of active subscriptions right after we connect our bank accounts. The system lets us:

- Track price changes over time

- Identify wasteful subscriptions

- Review transaction history by provider

- Monitor recurring payment patterns

Emma Pro Features

Emma’s three subscription tiers fit different needs. Plus membership includes simple features, while Pro adds advanced capabilities at $5.00 monthly. The Ultimate tier gives you:

- Unlimited bank connections

- Spaces for separated analytics

- Better tracking tools

- 4.24% APY on savings

Emma’s security features are robust with SSL 256-bit encryption and biometric authentication. Custom categories and split transaction features help us maintain precise control over our finances.

Simplifi

Image Source: Quicken

Simplifi stands out from other money-saving apps we tested because of its flexible budgeting approach. The app adapts to how we manage our money instead of forcing us into strict budget categories.

Simplifi Spending Plan

The app’s up-to-the-minute spending updates caught our eye immediately. Our monthly budget splits into four main parts, and we can see our daily spending allowance at a glance. The system works well because it:

- Automatically keeps track of bills and subscriptions

- Watches our savings goal progress

- Updates available money instantly

- Shows spending forecasts for up to 12 months

Simplifi Reports

The app’s reporting features are a big deal as it means that we get more insights than we expected about our spending habits. Users get more report options to customize compared to other personal finance apps. Here are the reports we love most:

| Report Type | Key Benefits |

|---|---|

| Spending Analysis | Category breakdowns with custom filters |

| Income Tracking | Detailed earnings patterns |

| Net Worth | Complete financial overview |

| Refund Status | Automated refund tracking |

Simplifi Subscription

We love Simplifi’s simple pricing at $47.88 per year, which often drops to $35.88. The subscription has everything you need:

- Customizable spending watchlists

- Live chat support

- Automatic transaction categorization

- Future month projections

Our extensive testing shows that Simplifi’s reasonable price tag delivers great value, thanks to its reliable mobile apps and smooth user experience.

Lunch Money

Image Source: lunchmoney.app

Lunch Money’s exceptional multi-currency features make it stand out from other budgeting tools. Users can combine accounts from different countries smoothly, which works great for people who manage money internationally.

Lunch Money Tracking

The Query Tool helps users analyze their spending patterns in new ways. Here’s what you can see with your expenses:

- Custom date ranges with single or multiple datasets

- Relative percentages or absolute data views

- Pie charts, bar graphs, and stacked visualizations

- Daily, weekly, or monthly breakdowns

Lunch Money Reports

This platform goes beyond simple budgeting with its complete analytics. Users can track business and personal expenses as separate entities. The system gives a clear explanation of spending habits and answers vital questions about vacation costs, transportation expenses, and top vendors in specific categories.

Lunch Money Pricing

Lunch Money made a bold change during 2023’s economic uncertainty by introducing a flexible annual pricing structure. Users can now choose what they pay, with options from $40 to $150 per year. This new approach has shown great results:

| Metric | Result |

|---|---|

| Revenue Growth | Nearly doubled |

| Premium Users | 37% pay above $100 annually |

| Revenue Share | 60% from premium tier |

The platform’s lifetime price lock guarantee ensures that your rate stays the same whatever future price changes occur.

Comparison Table

| App Name | Core Features/Focus | Monthly Cost (Premium) | Notable Benefits | APY Rate | Key Unique Feature |

|---|---|---|---|---|---|

| Rocket Money | Bill & Subscription Management | $4-$12 | 85% success rate in bill negotiations | Not mentioned | Saved users over $1B collectively |

| Monarch Money | Budgeting & Investment Tracking | $14.99 | Custom notifications, unlimited account connections | Not mentioned | Two distinct budgeting systems (Flex & Category) |

| PocketGuard | Automated Expense Tracking | $12.99 | Connects to 18,000+ financial institutions | Not mentioned | “In My Pocket” spending calculator |

| Goodbudget | Digital Envelope Budgeting | $8-$10 | Debt tracking, payment scheduling | Not mentioned | Digital envelope system |

| EveryDollar | Zero-based Budgeting | $17.99 | Users find avg. $790 in first 2 months | Not mentioned | Zero-based budgeting system |

| Stash | Investing & Banking | $3-$9 | Access to 3,800+ stocks/ETFs | Not mentioned | Stock-Back® Card rewards |

| Robinhood | Trading & Cash Management | $5 (Gold) | Commission-free trading | 4.65% (Gold) | 24-hour trading availability |

| Webull | Advanced Trading Tools | Free | 50+ technical indicators | Not mentioned | Paper trading simulator |

| Chime | Fee-free Banking | Free | Early direct deposit | 2% | SpotMe overdraft protection up to $200 |

| Current | Family Financial Management | Not mentioned | Early direct deposit | 4% | Teen banking features |

| Albert | AI-powered Savings | $11.99 | $25-$100 weekly auto-savings | 0.25% | Text-based financial advice |

| Empower | Wealth Management | $8 | Cash advances up to $300 | 3.75% | Daily portfolio rebalancing |

| SoFi | Complete Financial Services | Not mentioned | Commission-free trading | 4% | Career coaching services |

| Betterment | Automated Investing | $4 or 0.25% annually | 101 risk levels | 4% | Tax-loss harvesting |

| Wealthfront | Automated Portfolio Management | 0.25% annually | Access to 200+ ETFs | Not mentioned | Daily tax-loss harvesting |

| M1 Finance | Customizable Investing | Not mentioned | Commission-free trading | 4% | “Pie” investment model |

| Public | Social Investing | Free | AI-powered research assistant | 4.1% | Community insights |

| Fidelity Spire | Goal-focused Planning | Free | Goal tracking tools | Not mentioned | Free robo-advisor under $10k |

| Marcus | High-yield Savings | Free | No minimum deposit | 3.90% | CD accounts at 4.25% APY |

| Ally | Smart Savings Tools | Free | Bucket organization | 3.80% | Automatic savings features |

| Varo | Digital Banking | Free | Early direct deposit | 5% | Automated savings rules |

| Dave | Overdraft Prevention | $1 | Cash advances up to $500 | 4% | Side hustle board |

| Brigit | Financial Wellness | $9.99 | Cash advances up to $250 | Not mentioned | Credit building tools |

| MoneyLion | Credit Building | Not mentioned | Cash advances up to $1,000 | Not mentioned | 25-point credit score increase in 60 days |

| Credit Karma | Credit Monitoring | Free | Dual bureau monitoring | 4.1% | Direct dispute assistance |

| NerdWallet | Financial Planning | $49/year | Up to $425 annual rewards | Not mentioned | Smart Money Podcast |

| Clarity Money | Expense Analysis | Free | Connects to 9,000+ institutions | Not mentioned | AI-powered spending analysis |

| Prism | Bill Management | Free | 11,000+ biller connections | Not mentioned | $1,000 payment guarantee |

| Billshark | Bill Negotiation | 40% of savings | 90% success rate | Not mentioned | Average $300-$500 savings per bill |

| Hiatus | Subscription Management | $4-$9.99 | Bill negotiation service | Not mentioned | Subscription cancelation assistance |

| Cushion | BNPL Management | $4.99-$12.99 | Credit building features | Not mentioned | BNPL payment tracking |

| Copilot | AI-powered Budgeting | $13 | Unlimited account connections | Not mentioned | Emoji-enhanced budgeting |

| Emma | Financial Tracking | $5 (Pro) | Subscription monitoring | 4.24% | Fitness tracker style interface |

| Simplifi | Flexible Budgeting | $3.99 ($47.88/year) | 12-month projections | Not mentioned | Immediate spending updates |

| Lunch Money | Multi-currency Budgeting | $40-$150/year | Multi-currency support | Not mentioned | Custom query tool |

Conclusion

Our tests of 35 money saving apps showed clear winners for different financial tasks. Rocket Money and Billshark work best for bill negotiations. Betterment and Wealthfront excel at automated investing.

Users get better results when they mix multiple apps together. Most people pair a budgeting app like YNAB or PocketGuard with high-yield savings from Marcus or Ally. This combination helps them earn competitive APY rates and keeps their spending in check.

The best way to save money starts with free expense tracking apps. Users can then upgrade to premium features that match their financial goals. Premium services cost $3 to $15 monthly and give real value. They offer automated savings, custom insights, and expert guidance.

The perfect mix of money saving apps comes down to your financial priorities. These tools offer practical solutions whether you’re building emergency savings, paying off debt, or growing investments. Start with one or two apps that solve your immediate needs. You can add more apps later based on your results and comfort level.