Most people don’t realize that 70% of millionaires built their wealth through entrepreneurship. The path to wealth might seem overwhelming, but these success stories prove anyone can achieve it with the right mindset.

Self-made millionaires follow a clear pattern. They save more than 20% of their income and keep six to nine months of emergency funds ready. They also seek mentors to guide their decisions. These aren’t just theories – real people have used these methods to build net worths of $6 to $8 million.

Financial independence doesn’t require revolutionary ideas. You can speed up your trip to lasting wealth by learning from successful people’s strategies. Let’s look at seven proven methods that self-made millionaires use to build and protect their wealth.

Develop Financial Intelligence

Image Source: Yahoo Finance

Financial intelligence is the life-blood of wealth creation. A newer study shows that Americans rate their financial literacy at just 6.2 out of 10 [1], which shows a vital need for financial education.

Money Education Resources

The right resources will kickstart your financial education experience. Free online platforms are a great way to get detailed financial education. Platforms like Khan Academy, Coursera, and edX provide well-laid-out courses that cover simple money management to advanced investing [2].

Here are some top-rated resources to boost your financial knowledge:

- Financial Markets course from Yale University

- Personal & Family Financial Planning from University of Florida

- Behavioral Finance from Duke University [3]

Financial Literacy Basics

Core financial concepts are the foundations of your wealth-building experience. Financial literacy combines personal finance, financial concepts, and planning to help you build long-term stability [3].

These areas are vital to master financial basics:

| Learning Area | Key Focus |

|---|---|

| Personal Finance | Budgeting, saving, investing |

| Risk Management | Insurance, emergency planning |

| Investment Basics | Stocks, bonds, mutual funds |

Continuous Learning Strategy

A consistent learning approach helps you be proactive in your financial education. You should create a personal learning culture that values ongoing financial education [4].

Your continuous learning strategy should include:

- Regular participation in workshops and seminars

- Reading financial publications and journals

- Joining professional associations for networking opportunities [4]

Note that market trends and regulatory changes help you make informed decisions. This knowledge helps you adapt your strategies to new market conditions and economic changes [5].

Set specific financial education goals to maximize your learning. You might want to master one new financial concept each month or complete a certified course every quarter. This approach will give a steady progress in building your financial intelligence [4].

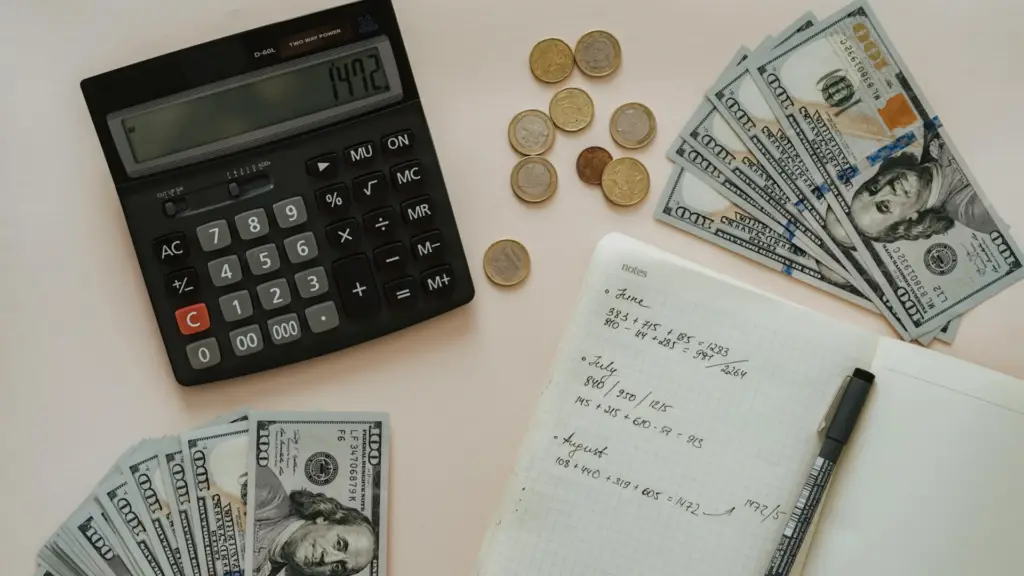

Master Cash Flow Management

Image Source: Mercer Advisors

Smart cash flow management powers your experience toward financial freedom. As Warren Buffett wisely states, “Do not save what is left after spending; instead spend what is left after saving” [6].

Budgeting for Wealth

A strategic budget is the life-blood of effective cash management. The 50/30/20 rule creates a solid framework for your financial success [7]:

| Category | Allocation | Has |

|---|---|---|

| Needs | 50% | Housing, groceries, utilities |

| Wants | 30% | Entertainment, dining out |

| Savings | 20% | Investments, emergency fund |

Expense Optimization

Tracking your spending helps maximize your wealth-building potential. Here are proven strategies:

- Set up automatic payments for bills to avoid late fees

- Review and cancel unused subscriptions

- Negotiate better terms with service providers

- Track expenses using budgeting apps

Successful wealth builders keep six to nine months of emergency expenses [8]. This preparation helps avoid debt accumulation and handles unexpected costs.

Income Maximization

Building wealth needs two key approaches: controlling expenses and increasing income. Here are income-boosting strategies successful people use:

- Pursue additional education or training to increase earning potential

- Negotiate salary increases backed by performance data

- Develop multiple income streams through side businesses

- Explore passive income opportunities like rental properties [8]

These strategies create a positive cash flow where your income exceeds expenses. This surplus becomes your wealth-building foundation and lets you invest in opportunities that generate additional income [1].

Note that automating your finances works best. Set up automatic transfers from your checking account to emergency savings and investment accounts [7]. This system moves you toward financial goals without relying on willpower alone.

Build Your Emergency Arsenal

Image Source: America Saves

Building a strong financial safety net will protect your wealth-building trip. Your emergency arsenal acts as your first defense against unexpected challenges in life.

Emergency Fund Strategy

Your emergency fund should cover three to six months of simple living expenses [9]. If you’re the sole breadwinner or have variable income, you should save nine to twelve months of expenses [10]. Here’s a breakdown of emergency fund targets:

| Income Situation | Recommended Safety Net |

|---|---|

| Dual Income | 3-4 months of expenses |

| Single Income | 6-9 months of expenses |

| Variable Income | 9-12 months of expenses |

Your emergency fund works best in a high-yield savings account that gives you both safety and easy access [10]. Your money stays protected while earning competitive interest rates.

Risk Management Plan

A detailed risk assessment helps identify potential financial threats to your stability alongside your emergency fund [11]. These key areas need attention while developing your risk management strategy:

- Assess potential income loss scenarios

- Check health and medical risk exposure

- Review property and asset vulnerabilities

- Identify your family’s specific financial risks

- Monitor and update protection strategies regularly

Financial Safety Nets

Multiple layers of protection make your financial security stronger [12]. Your safety net should have adequate insurance coverage in all aspects of your life [11]. You need health insurance for medical expenses, disability coverage to protect income, and property insurance to protect assets [13].

Your financial safety net will work better with these protective measures:

- Open a dedicated emergency savings account separate from your regular checking [14]

- Set up automatic transfers to build your safety net consistently [14]

- Review and adjust your insurance coverage annually [11]

- Create a risk management plan that grows with your financial situation [13]

Note that you should monitor and reassess your emergency arsenal as your financial circumstances change [11]. This active approach will keep your protection strategies arranged with your current needs and future goals.

Create Business Ownership Path

Your path to financial independence might lead you to start your own business. All the same, successful entrepreneurs know that building an environmentally responsible business needs careful planning and strategic execution.

Business Model Selection

The right business model is significant to long-term success. Entrepreneurs who break down multiple business strategies before launching tend to succeed more often [15]. Here are some proven models to think about:

| Business Type | Key Advantage | Best For |

|---|---|---|

| Franchise | Proven system | Risk-averse starters |

| Subscription | Predictable revenue | Service providers |

| Lean Startup | Low original cost | Tech innovators |

| Cooperative | Community support | Social enterprises |

Start-up Strategy

A small start helps you test your concept while minimizing risk [16]. These elements are the foundations of your startup experience:

- Confirm your idea through side projects or freelance work

- Solve specific market problems

- Build a network of mentors and industry experts

- Secure adequate funding for your first year [16]

Common misconceptions aside, you don’t need everything figured out at launch. Successful entrepreneurs start with their expertise and expand gradually [16].

Scale-up Timeline

Each growth phase needs proper capital connection [3]. Your scaling experience should hit these key milestones:

- Early Access Phase

- Test your product with limited audience

- Gather customer feedback

- Refine your offering

- Customer Success Phase

- Build referenceable customer base

- Track usage metrics

- Document success stories

- Predictable Growth Phase

- Establish repeatable sales process

- Optimize customer acquisition

- Create adaptable systems

On top of that, your product should be ready to sell before you expand your team [3]. Your focus should be on building automated systems that handle increased sales and work output economically [3].

Your scaling success depends on identifying the right time for additional capital. Many entrepreneurs rush to hire sales teams right after finding product-market fit, but this approach often hurts company performance [3]. A better strategy works backward from your cash runway to define achievable milestones and realistic timelines.

Note that your business needs regular reinvention as market conditions change [2]. Successful entrepreneurs surround themselves with people smarter than they are [2], which ensures continuous state-of-the-art and growth in their business experience.

Master Real Estate Investing

Image Source: freepik

Real estate investing remains one of the most reliable ways to build lasting wealth. Research shows that all but one of these millionaires have invested in real estate as part of their wealth-building strategy [4].

Property Investment Basics

The first step to real estate investing involves understanding the fundamentals. You’ll need to evaluate your financial health, credit score, reliable income sources, and savings for down payments [4]. These simple elements matter before you invest:

| Investment Type | Key Benefits | Initial Requirements |

|---|---|---|

| Single-family homes | Lower maintenance | 15-25% down payment |

| Multi-family units | Higher cash flow | Strong credit score |

| Commercial properties | Long-term leases | Substantial capital |

Real Estate Strategy

Successful real estate investing needs a methodical approach. You should start small and focus on properties that generate positive cash flow instead of relying only on appreciation [4]. A winning strategy should include:

- Local market dynamics and economic factors

- Neighborhood trends and rental rates

- Appreciation patterns in target areas

- Relationships with industry professionals

Market analysis helps you identify properties that match your financial goals better. Russell Sage points out that “real estate is an imperishable asset, ever increasing in value” [17].

Portfolio Building

Your real estate portfolio needs patience and strategic planning. Single-family homes or duplexes make great starter properties [4]. Here’s how to grow your portfolio:

- Focus on Cash Flow

- Rental income should exceed expenses

- Calculate operating costs (35-80% of gross income) [5]

- Keep reserves for maintenance

- Diversification Approach

- Mix property types

- Look at different locations

- Try various investment strategies

Smart investors set aside 1% of property value each year for maintenance costs [4]. You’ll also need a reliable team that includes a real estate agent, property manager, attorney, and contractor to support your investment goals [4].

Note that real estate investing works better as a team effort. Property managers charge between 8-12% of collected rents [18], but they are a great way to get proper maintenance of your properties and handle tenant relationships.

Network with High Achievers

Image Source: Pexels

The size of your network shapes your net worth. Research shows that 76% of working professionals believe mentorship is vital for growth [19]. Yet more than 54% don’t have these relationships [19].

Strategic Networking Tips

You need a well-laid-out approach to build meaningful connections. The focus should be on creating authentic relationships that benefit both parties. These proven networking strategies can help:

| Networking Approach | Key Focus | Expected Outcome |

|---|---|---|

| Value-First | Offer help before asking | Long-term relationships |

| Active Listening | Understanding others’ needs | Deeper connections |

| Strategic Events | Industry-specific gatherings | Targeted networking |

| Digital Presence | Online community engagement | Broader reach |

The numbers speak for themselves – 90% of people with workplace mentors find these relationships valuable [20]. This shows why strategic networking matters.

Mentor Relationship Building

The right mentor can speed up your path to financial freedom. Here’s what you need to build successful mentor relationships:

- Define clear goals and specific needs for the mentorship

- Research potential mentors through your second-degree network

- Create a simple, focused outreach message

- Set up regular check-ins and communication patterns

- Track progress and share achievements

Mentors who invest in your growth help you learn faster and move up in your career [21]. Studies reveal that mentees get promotions five times more often [20].

Wealth Circle Creation

A powerful wealth circle connects you with like-minded people who share your financial goals. Your circle should include people who challenge your thinking and open new doors.

To build a wealth circle that works:

- Identify Your Core Group

- Look for diverse expertise and experience

- Mix peers with seasoned professionals

- Pick quality over quantity

- Nurture Relationships

- Show up at industry-specific events

- Join professional associations

- Take part in mastermind groups

- Maintain Active Engagement

- Share useful insights often

- Celebrate when others succeed

- Help during tough times

Smart people use their networks well – 53% of Americans want to start businesses but worry about going solo [6]. About 56% say a supportive network would boost their confidence [6].

Stay real in your networking efforts. Studies show that mentorship relationships built on trust and clear expectations bring the best results [7]. Build genuine connections and nurture them regularly. Your network will support your trip to financial freedom.

Live Below Your Means

Image Source: MoneyLion

Building financial abundance begins with a simple truth – spend less than you earn. Research shows that all but one of these self-made millionaires save at least 16% of their monthly income [22]. This habit is the life-blood of wealth building.

Lifestyle Design Strategy

A green financial lifestyle needs careful planning and smart choices. We focused on helping wealth builders keep six to nine months of emergency expenses [8]. This protects them from unexpected costs. Let’s take a closer look at these lifestyle elements:

| Lifestyle Area | Strategic Approach | Effect |

|---|---|---|

| Housing | Choose modest options | Reduced fixed costs |

| Transportation | Buy & maintain long-term | Lower depreciation |

| Entertainment | Focus on value | Controlled spending |

Smart Spending Habits

Smart spending focuses on making informed choices rather than cutting back. Studies show that the second generation loses most wealth [22]. This highlights why solid financial habits matter. Here are proven ways to spend mindfully:

- Review and cut unused subscriptions

- Take time before big purchases

- Buy certified pre-owned vehicles instead of new ones [23]

- Look for deals on needed expenses

- Use technology until it breaks down

Wealthy people stick to their frugal habits even after success. They might pick economy plus on flights but skip first class [23]. This shows how wealth preservation needs constant discipline.

Wealth Preservation Tips

Protecting your wealth is as vital as building it. A complete wealth preservation plan has these key parts [22]:

- Tax Optimization

- Employ tax-advantaged accounts

- Think about irrevocable trusts

- Plan for estate efficiency

- Risk Management

- Keep adequate insurance coverage

- Broaden investment portfolio

- Build asset protection structures

- Legacy Planning

- Pass on financial literacy to heirs

- Write down wealth transfer plans

- Update estate documents often

Of course, good wealth preservation guards your assets through smart financial management [22]. This means careful tax planning and using tax-advantaged accounts. These steps cut your tax burden and help pass wealth smoothly to future generations.

Note that wealth preservation goes beyond keeping assets – it means growing them responsibly. A balanced mix of asset classes cuts risk [22] and helps steady growth over time. These strategies create a lasting legacy that benefits future generations.

Comparison Table

| Financial Freedom Tip | Key Focus | Implementation Strategy | Recommended Tools/Resources | Success Metrics |

|---|---|---|---|---|

| Develop Financial Intelligence | Building foundational knowledge | Learning through courses and workshops | Khan Academy, Coursera, edX, Yale Financial Markets course | Financial literacy rating improvement (current average: 6.2/10) |

| Become skilled at Cash Flow Management | Smart budgeting and expense control | 50/30/20 rule (50% needs, 30% wants, 20% savings) | Budgeting apps, Automatic payment systems | 6-9 months of emergency expenses managed to keep |

| Build Your Emergency Arsenal | Creating financial safety nets | Tiered savings based on income | High-yield savings accounts | 3-12 months of expenses (varies by income type) |

| Create Business Ownership Path | Business growth development | Test concept, scale step by step | Mentors, industry experts | Steady revenue growth, green practices |

| Become skilled at Real Estate Investing | Building property portfolio | Begin with single-family homes, focus on returns | Property managers (8-12% of collected rent) | 1% of property value for maintenance, positive cash flow |

| Network with High Achievers | Building mutually beneficial alliances | Value-first approach, active listening | Industry events, professional associations | 76% professionals consider mentorship vital |

| Live Below Your Means | Smart spending habits | Choose modest lifestyle | Tax-advantaged accounts, budgeting tools | Save minimum 16% of monthly income |

Conclusion

Seven financial freedom strategies from self-made millionaires offer a proven roadmap to build lasting wealth. Successful people don’t chase quick fixes. They build strong financial foundations through continuous learning and disciplined money management.

Building a six to nine month emergency fund and saving over 20% of your income creates financial stability. Smart real estate investments and business ownership help you create multiple income streams. Of course, high-achieving mentors speed up your trip by sharing their wisdom and opening new doors.

These strategies need dedication, but you can start small and make steady progress toward your financial goals. Your path to financial independence starts when you implement one strategy at a time – whether you improve your financial knowledge, optimize cash flow, or build valuable relationships.

Note that wealth creation isn’t about making more money – it’s about making smarter decisions with the money you have. Live below your means and invest consistently in assets that generate long-term value. Your trip to financial freedom starts today with these time-tested principles that have helped countless others achieve their wealth-building dreams.